Forensic Accounting

Michael Goldman - CPA, CFE, CFF

Michael

Goldman has strong

analytical skills and is detail-oriented, insightful, inquisitive, and honest. He has

an expert's ability to identify key issues and communicate complex subject matter

in a simple manner.

Michael

Goldman has strong

analytical skills and is detail-oriented, insightful, inquisitive, and honest. He has

an expert's ability to identify key issues and communicate complex subject matter

in a simple manner.

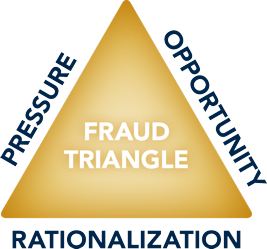

Certified Fraud Examiners

![]() Denoting

proven expertise in the subject of fraud, the CFE credential recognizes

knowledge in Fraud Prevention and Detection, Fraudulent Financial Transactions,

Fraud Investigation, and Legal Elements of Fraud.

Denoting

proven expertise in the subject of fraud, the CFE credential recognizes

knowledge in Fraud Prevention and Detection, Fraudulent Financial Transactions,

Fraud Investigation, and Legal Elements of Fraud.

Michael Goldman's Approach to Forensic Accounting:

"Forensic" means being able to meet the exacting standards of a court of law. The methods employed must be relevant, reliable, and the product of sound scientific methodology. To be considered "scientific methodology" the methods must be empirically tested, subjected to peer review and professional standards, and generally accepted by the relevant professional community.

Forensic Accountant's skillsets include an understanding of the legal process, investigative techniques, financial analysis, accounting procedures, and common business practices. They focus on the numbers, but understand that numbers are symbols representing broad patterns of activity, and that the ultimate goal is to understand, simplify, and explain what really happened in a business.

In other words, a good forensic accountant will start with the accounting

data but will go beyond the numbers and ledgers and reports and focus on the

underlying realities of the business. Michael Goldman uncovered 11 years

of skimming and inventory theft in a manufacturing company that had been missed

by both Department of Revenue auditors and bank auditors, when he noticed that

the shipping clerk's office wasn't near the shipping dock, she had accounting

documents not normally worked on by a shipping clerk, and that she had the most

technologically advanced equipment in the company (she was creating the

off-books invoices). Another multi-million dollar fraud case was resolved

when Michael Goldman noticed the same unusual gramatical mistakes on invoices

from separate vendors, ultimately leading to a confession of fabricated invoices

and improper cash payments.

In other words, a good forensic accountant will start with the accounting

data but will go beyond the numbers and ledgers and reports and focus on the

underlying realities of the business. Michael Goldman uncovered 11 years

of skimming and inventory theft in a manufacturing company that had been missed

by both Department of Revenue auditors and bank auditors, when he noticed that

the shipping clerk's office wasn't near the shipping dock, she had accounting

documents not normally worked on by a shipping clerk, and that she had the most

technologically advanced equipment in the company (she was creating the

off-books invoices). Another multi-million dollar fraud case was resolved

when Michael Goldman noticed the same unusual gramatical mistakes on invoices

from separate vendors, ultimately leading to a confession of fabricated invoices

and improper cash payments.

Forensic accountants must be curious, observant, persistent, and able to

detect abnormalities in patterns. Usually they are looking for

something that was intentionally hidden, and the path to finding it goes

through circumstantial evidence or pulling on loose threads to see what

unravels. If you've ever played the game of looking at a picture

and having to find what doesn't belong there, or what should be there and

isn't, that is similar to a fraud investigation. Once the desired

evidence becomes more obvious, the forensic accountant reverts back to more

traditional accounting and investigative techniques (see Michael Goldman's

articles on fraud investigation).

patterns. Usually they are looking for

something that was intentionally hidden, and the path to finding it goes

through circumstantial evidence or pulling on loose threads to see what

unravels. If you've ever played the game of looking at a picture

and having to find what doesn't belong there, or what should be there and

isn't, that is similar to a fraud investigation. Once the desired

evidence becomes more obvious, the forensic accountant reverts back to more

traditional accounting and investigative techniques (see Michael Goldman's

articles on fraud investigation).

Knowing what to expect is one of the most useful tools in being able to find what is missing or was hidden, whether it was intentional or not. Michael Goldman has 14 years of experience as a corporate manager in the accounting, finance, and operational areas plus hands-on consulting experience (either investigating, valuing, or assisting in the turnaround and restructuring) of well over 100 companies. This deep experience combines with his natural inquisitiveness and professional judgment to provide him with a unique perspective and approach to forensic assignments.

Forensic accountants must be able to both handle minute details and see the big picture at the same time. They need to be observant and good listeners. They have to be able to communicate both clearly and concisely. Much of this can come from training, some of it needs to be innate. When you cannot find the money, the numbers don't make sense, or you need to prove your case in court, Michael Goldman has the knowledge and experience to help you.

A Leader in the Field:

Michael Goldman has been published in Aspen Law's Valuing Professional Practices and Licenses, the Illinois Divorce Digest, The Value Examiner, The Corporate Counselor, Westlaw's Strategic Alternatives for Distressed Businesses, the Association of Certified Fraud Examiners' Fraud Casebook, and the American Bankruptcy Institute's Commercial Fraud Manual. His articles have been used in national training courses and the graduate level course he teaches consistently earns high evaluations from students.

Michael Goldman has been a member of the Editorial Board of The Value Examiner since June, 2008. In January 2012 he was appointed Chairman of the Editorial Board. He is also a Leader on the American Bankruptcy Institute's Fraud Task Force.